Hope you guys enjoyed my previous post on S&P 500. Looks like the markets set out in Jan just to make my mind waver on my 2019 forecast.. But no, I am not changing my mind or my bearish forecast.

The much needed relief rally has come through, thanks to the Fed Chair Mr Powell’s dovish statements on Jan 4. Subsequently fueled by the prospect of a resolution to the US-China trade war, this rally / spike has been bigger than what any one would have thought of..

However, after what happened with AAPL a few weeks ago (lowered guidance for iPhones and the problems in China market), and the negative outlook developing for autos, retail and a few other sectors as evidenced by the 2019 guidance released by some companies, I have more conviction about the return of the bearish trend that started in Oct 2018. And this is despite the fact that markets have registered a mind-boggling 8 week run from the Dec lows with the indices notching up a 10-12% gain in Jan 2019 alone. Here is my forecast for the DOW for the next 4 – 6 months.

S&P and DOW:

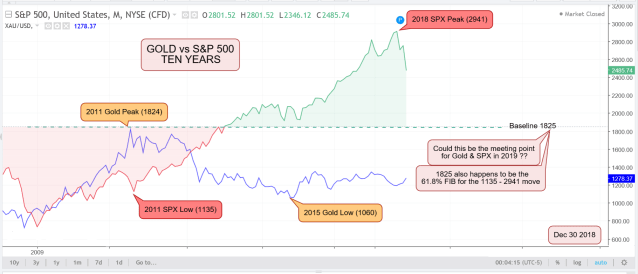

While an “extreme target” for the S&P 500 would be 1825 (as explained in the previous post), I do think that a moderate target of 2300 -2400 still has a great possibility of being met mid-year. My confidence level on this target is no doubt down a bit since S&P closed last week above the critical 2720 levels but it is not fully gone.

For 1825 to happen, markets have to crash and for that to trigger, we need more confirmatory signals on a 2019 recession + escalation of trade wars (please don’t get me wrong, I don’t wish for either event). However, 2300 – 2400 for the S&P and 21600 -22000 for the DOW still look quite feasible in my perspective.. The million dollar question is – will the markets turn around right now or only after pushing to new highs that take SPX to 3000 and DOW beyond 27000? And will we start seeing an Earnings recession in Q2 or Q3?

There seem to be enough signals from the charts, as well as from fundamentals (retail sales data for Q4, lower guidance from any companies for 2019, and revision of the Q1 GDP forecast from 2.17% to 1.08% by the NY Fed, to name a few) and most importantly from the Fed outlook itself that can lead us to those targets.

Sample this and tell me how conflicting this one is: We have a “very strong” economy but this economy CAN NOT tolerate a 2.5 to 3% interest rate so Fed has to turn dovish all of a sudden? smh!

So here are my targets for Q2/Q3 2019:

DJI (DOW Jones): 23350 (moderate), 21600 (aggressive)

SPX (S&P 500): 2350 – 2400 (moderate), 2050 & 1825 (aggressive)

NDX (Nasdaq 100): 6400 – 6500 (moderate), 5800 (aggressive)

GOLD: 1500 – 1550

**Aggressive targets : valid if more recessionary signals show up in the next few weeks

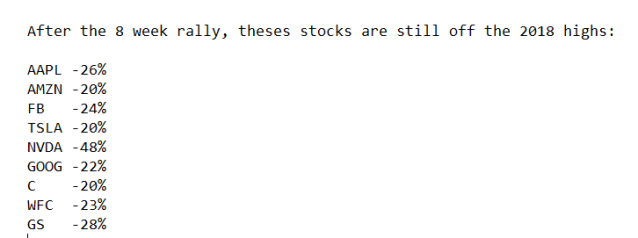

Now here is another interesting fact: The status of some major stocks after the mind-boggling 8 week rally! (status as of Feb 13, 2019):

It is one thing to have bought the Dec lows (kudos if you did) but to be long at the current levels or to be buying at current levels after a 18% rally in 8 weeks does not seem wise to me. So folks, wake me up when the bull market is really back (that is, if & when indices start to register new all-time-highs)